MUST WATCH

Now Playing Fiorina: Big tech...

(16 Videos)

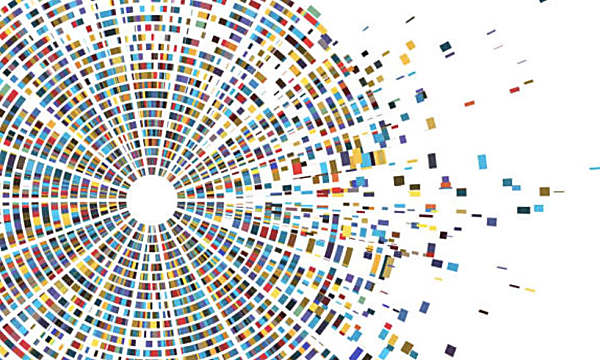

New York (CNN Business)America's debt load is about to hit a record. The combination of cheap money and soaring debt helped fuel the decade-long economic expansion and bull market, but America's gluttony of loans could work against it if its fragile economic balance shifts.

In the first quarter of 2019, the United States' total public- and private-sector debt amounted to nearly $70 trillion, according to research by the Institute of International Finance. Federal government debt and liabilities of private corporations excluding banks both hit new highs.

Debt in itself isn't bad. Borrowing can help governments and businesses grow by funding important projects and services that make the economy stronger. And right now, the United States can still deal with its debt burden. The economy, about $21 trillion in size, remains healthy, and the Federal Reserve is preparing to cut interest rates and make debt even cheaper. But America's near-record liabilities could be dangerous down the road.

Worsening fiscal report card

America's economy is beginning to show some cracks. Manufacturing is slowing down, and the trade war is hurting economies around the world.

The United States remains one of the most attractive places to invest, and its sovereign debt continues to be a safe bet for investors. But if the economy slows, the United States will have to continue relying on investors — and in particular foreign nations — to buy its bonds.

That will probably still happen. But the United States isn't making matters easy for itself.

The government could run out of money by early September, before Congress gets back from its summer break, the US Treasury Department said Friday. That is why Treasury Secretary Steven Mnuchin requested that Congress raise the debt ceiling before the summer recess. Talks between Mnuchin and Speaker of the House Nancy Pelosi have been productive, the Treasury secretary said Monday.

The government has not been able to borrow money since March, because of congressionally mandated borrowing limits. If a fractured government fails to raise or temporarily suspend the debt ceiling, the United States could default on its debt, raising its borrowing costs and potentially throw the global economic system into chaos.

America has a lot of debt to pay back. The Treasury Department reported that the budget deficit jumped more than 23% between October and the end of June, widening some $750 billion. That is in part due to President Donald Trump's 2017 tax cuts. US debt is at a new all-time high because of increases in government borrowings, which now amount to 101% of GDP, the IIF says.

In the long run, however, easier financial conditions from central banks, including the Federal Reserve, "will support further debt buildup, exacerbating concerns about debt service burdens and sovereign debt sustainability," wrote IIF analysts led by Emre Tiftik, deputy director of global policy initiatives.

The Fed is expected to cut interest rates at the end of the month.

But lower rates will be only a limited help in lowering the United States' interest burden, which amounted to an annualized $830 billion in the first quarter. If the Fed cut rates by 100 basis points, or 1%, this bill could be some $20 billion to $25 billion lower per year, the IIF said. That's not nothing, but interest remains a financial burden for the United States.

Last year, investors already worried about the so-called twin deficit — comprising the United States budget and current account deficit, or the gap in the country's global trade. Although the market may have moved on to other issues, the twin deficit is still alive and kicking — and growing.

Mounting corporate credit

Corporate America's debt situation isn't much better.

An increase in bank lending has helped non-financial corporate debt climb to new highs: 74% of GDP, according to the IIF.

With the Fed preparing to cut interest rates, this trend is unlikely to reverse. Lower rates could allow companies with a large debt burden to breathe a sigh of relief, because it will become cheaper for them to refinance. But it will also invite companies with poor credit profiles to continue borrowing for less in the open market.

Corporate America's profits are expected to have fallen in the second quarter — the second straight decline. And Wall Street analysts expect that to happen again in the current quarter. That means some companies may not be able to afford to pay back their debt if the market and economy take a turn for the worse.

"Growing concern about the earnings outlook underscores risks for highly leveraged firms," wrote the analysts.

Higher debt burdens also won't do much to improve business sentiment and investment, which has already been hurt by the trade war.

Global risk

Concerns about rising debt levels aren't confined to the United States.

The global balance of borrowings is over $246 trillion, nearly 320% of worldwide GDP and just shy of the all-time high it reached in the first quarter of 2018. That means, overall, the world is borrowing more than it is producing. It is living beyond its means, so to speak. Such a massive pile of it puts the world — and emerging markets in particular — at risk to sudden shifts in market conditions.

If conditions change quickly, it could be harder for countries with lesser credit quality to refinance outstanding debt.

Borrowings are expected to grow as developed market central banks are shifting their policy stance back to easing mode. This could undermine "deleveraging efforts and reigniting concern about long-term headwinds to global growth," said the IIF.

debt pile

![[Pics] Dad Forces Daughter to Call Off Her Wedding. 50 Years Later, She Finds This in Mom’s Wallet [Pics] Dad Forces Daughter to Call Off Her Wedding. 50 Years Later, She Finds This in Mom’s Wallet](https://images.outbrainimg.com/transform/v3/eyJpdSI6IjJhMzc3YWJlYTUyYzE4MDcyNDY1ZTU4NTQ5YTAzYWM0YjU0OGI1NGEzZjYxMTg2OThlMGE0ZDYwMzZjOTdkYjYiLCJ3Ijo0MDAsImgiOjI0MCwiZCI6MS41LCJjcyI6MCwiZiI6MH0.jpg)

![[Pics] Husband Introduces Wife To The Wild Gorilla He Raised, But A Minute Later This Happens [Pics] Husband Introduces Wife To The Wild Gorilla He Raised, But A Minute Later This Happens](https://images.outbrainimg.com/transform/v3/eyJpdSI6ImRkNjVkM2FkYWJhYzA3ODhmZDA5MWVlNGE2ZmM1MGU1ODA4ODE1NDAxYmFlYjNkYTYyYzc2NzE2MjlhZjJjMWQiLCJ3Ijo0MDAsImgiOjI0MCwiZCI6MS41LCJjcyI6MCwiZiI6MH0.jpg)

![[Pics] The Giant Blooper Everyone Missed In This Iconic 'Pretty Woman' Scene [Pics] The Giant Blooper Everyone Missed In This Iconic 'Pretty Woman' Scene](https://images.outbrainimg.com/transform/v3/eyJpdSI6Ijg2NWMwMzVkNWNiN2M2NjZmZTkyNzcwMzQyZjIzZTM1MDk3NGQ5NTIxMDQzMTBhYzI2YWJiODRiNmU0Y2E2ODYiLCJ3Ijo0MDAsImgiOjI0MCwiZCI6MS41LCJjcyI6MCwiZiI6MH0.jpg)

No comments:

Post a Comment